Economy tense, seismograph relaxed.

A month ago we pointed out that the economic component of the private wealth indicator would probably give a sell signal at the end of July and therefore reduced the equity quota somewhat as a precaution. Now this fear has come true.

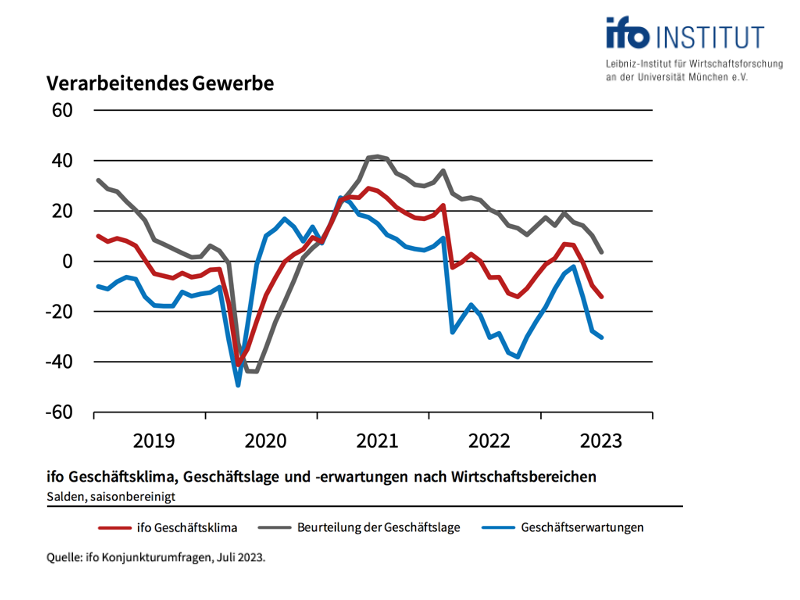

You know: The decisive role in the analysis of the economic trend in the private-wealth stock market indicator is played by the monthly survey of the ifo Institute on business expectations in German industry. Here the participants have a choice between three answer options: They expect their business to be either "more favourable", "unchanged" or "less favourable" over a six-month horizon. The balance value of the business expectations published by the ifo Institute is the difference between the percentages of the answers "more favourable" and "less favourable".

If this indicator deteriorates three times in a row in industry after a sustained rise, the business cycle component of the private-wealth stock market indicator switches from "green" to "red".

This is exactly what has happened now. Business expectations in the industrial sector had risen steadily from November 2022 to April 2023. Then in May, June and July, the index fell from minus 2.2 in April 23 to minus 14.2 and minus 27.8 to minus 30.4 points most recently (chart below). This deterioration three times in a row fulfils the criterion of a fundamental sell signal for the stock market indicator. The ifo data now suggest a recession for German industry in the second half of 2023.

Equity investors should therefore become more cautious. For companies, the starting situation is deteriorating drastically. In the past months, many still benefited from inflation. Sales increased significantly in nominal terms. With stable demand, profit margins could be defended or even increased - you remember the discussion about greedflation.

That seems to be over now.

Weak demand does not allow for further price pass-through. Meanwhile, the annual rate of change in producer prices is close to the zero line. At the same time, wages and thus unit labour costs continue to rise. This must be having an impact on the brands. Profits are coming under pressure.

Given this constellation, the valuation of the German stock market still seems rather high to us. After all, the DAX is trading close to the long-term fair value calculated by the private-wealth model.

From this perspective, we have taken a closer look at past data. In the past 60 years, we can identify ten cases in which the ifo expectations component in the manufacturing industry had crashed by a similar amount. In 9 out of ten cases, the DAX was trading well below the 80 percent mark of its fair value at the time and had already reacted to the deterioration of the economic situation.

Only in August 2008 were business expectations similarly low and the DAX valuation similarly high as today. At that time, the DAX lost around 40 percent of its value in the following six months.

This does not have to happen again. But the risk for equity investors is increasing. The private-wealth stock market indicator takes this constellation into account and further reduces the corridor for the strategic equity quota to 45 to 75 percent of the individually intended equity share. Accordingly, the cash quota is increased in order to be able to act in the event of price declines.

Within this strategic corridor, the capital market seismograph decides on the exact allocation. As you know, the seismograph combines various variables - early economic indicators, interest rate developments or price fluctuations on the stock markets - and distils the probabilities for three market states in the next month. Green stands for the expectation of a calm, positive market. Investors should invest in shares in this environment. Yellow indicates the probability of a turbulent positive market - investing, but with a sense of proportion. And red indicates the probability of a turbulent-negative market. In this case, abstinence from equity investments is the order of the day.

The capital market seismograph gave a thunderstorm warning at the beginning of July. Since then, however, it has gradually eased again. "The red probability is now decidedly low again, the "positive" probabilities yellow and green clearly have the upper hand," informs Oliver Schlick, who translates the signals of the seismograph into allocation proposals for Secaro GmbH, and continues: "After the thunderstorm warning, the seismograph had initiated the re-entry a week ago. Given the absolute dominance of the probability of positive turbulence, it is now appropriate to be fully invested again."

That is interesting. How can it be that the seismograph, which also takes early economic indicators into account, is so relaxed, even though the signs in Germany point to recession? "Firstly, the seismograph focuses on the global economy, where things are looking much better. And secondly, it also incorporates market sentiment via various interest rates." The market obviously expects an end to the restrictive monetary policy soon, which in turn would be positive for the capital markets. "A longer continuation of the restrictive phase now seems as good as ruled out," says Schlick.

The bottom line:

The economic development in Germany and the market valuation of the DAX define the strategic corridor for the equity allocation of the private-wealth stock market indicator. After the sell signal of the economic component, this lies at 45 and 75 percent of the individually intended equity share.

Within this range, the capital market seismograph determines the exact positioning of the private-wealth stock market indicator. Since the seismograph considers a full investment to be indicated, the concrete share quota suggested by the stock market indicator is set at 75 percent of the individually intended share quota.

This result is surprising at first glance. After all, the equity quota increases slightly from 70 to 75 percent compared to the previous week, despite the deterioration of the economic situation. This reflects the influence of the seismograph within the strategically set corridor. The clear improvement in the probability landscape is currently overcompensating for the cyclical reduction in the equity ratio.

This can change again quickly. We are therefore monitoring the seismograph very closely and will keep you informed.

Yours sincerely,

Klaus Meitinger

Note: Despite careful selection of sources, no liability can be accepted for the accuracy of the content. The information provided in private wealth is for informational purposes and is not an invitation to buy or sell securities. For a more detailed explanation of the private wealth stock market indicator, please read "News from the editorial office - strategic buy signal for German shares" of 25 January 2023.