Economic recovery ‘on track’.

We wrote here a month ago that the German economy should have bottomed out in February. The ifo Business Climate Index data for April supports this assessment. Sentiment among companies continued to improve last month, and the stabilisation process of the economy is still proceeding according to the textbook.

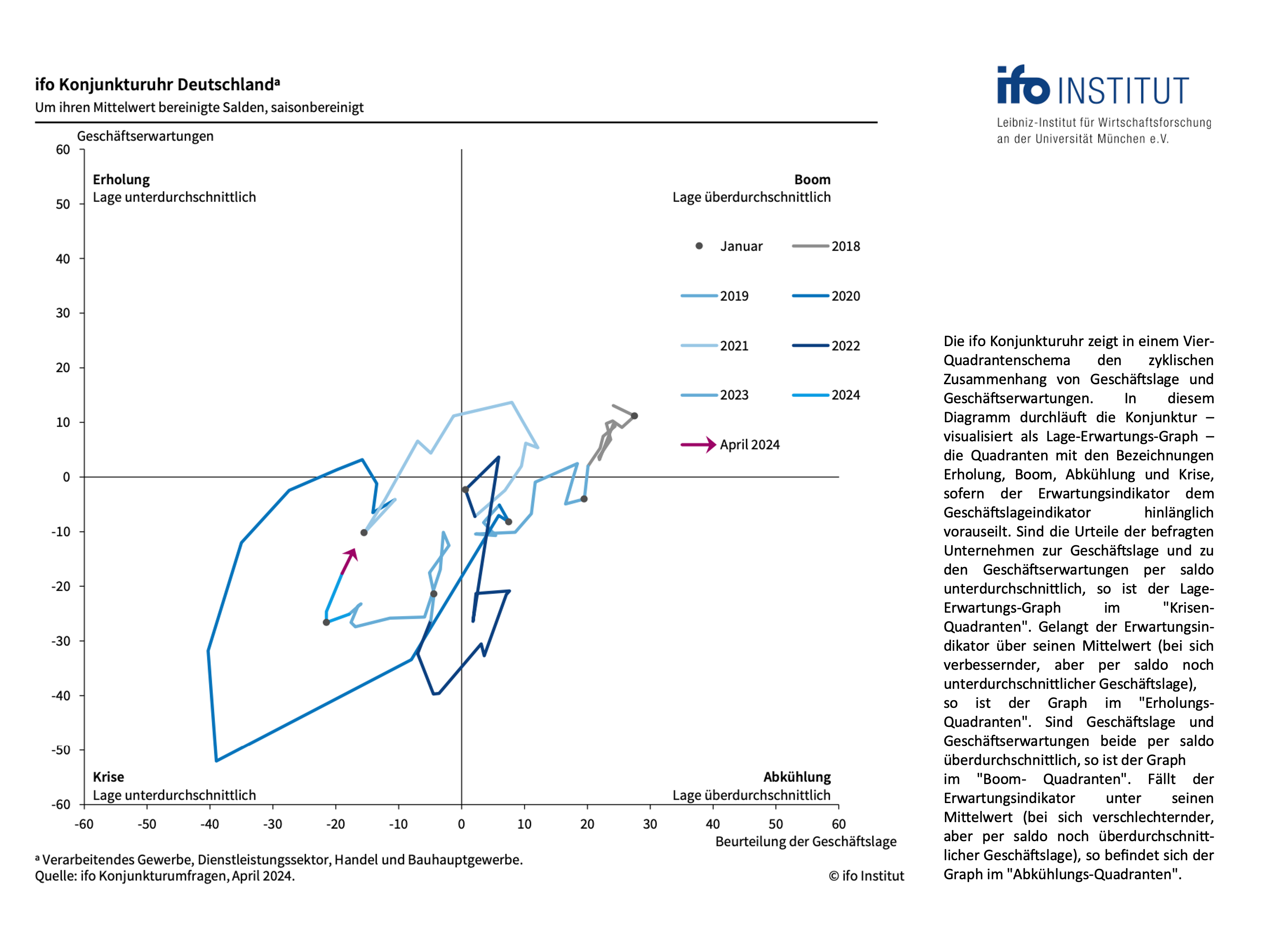

This can be seen most clearly in the ifo Business Cycle Clock. The German economy is still in the crisis quadrant. However, in April the indicator made a big leap towards the recovery quadrant (Chart 1).

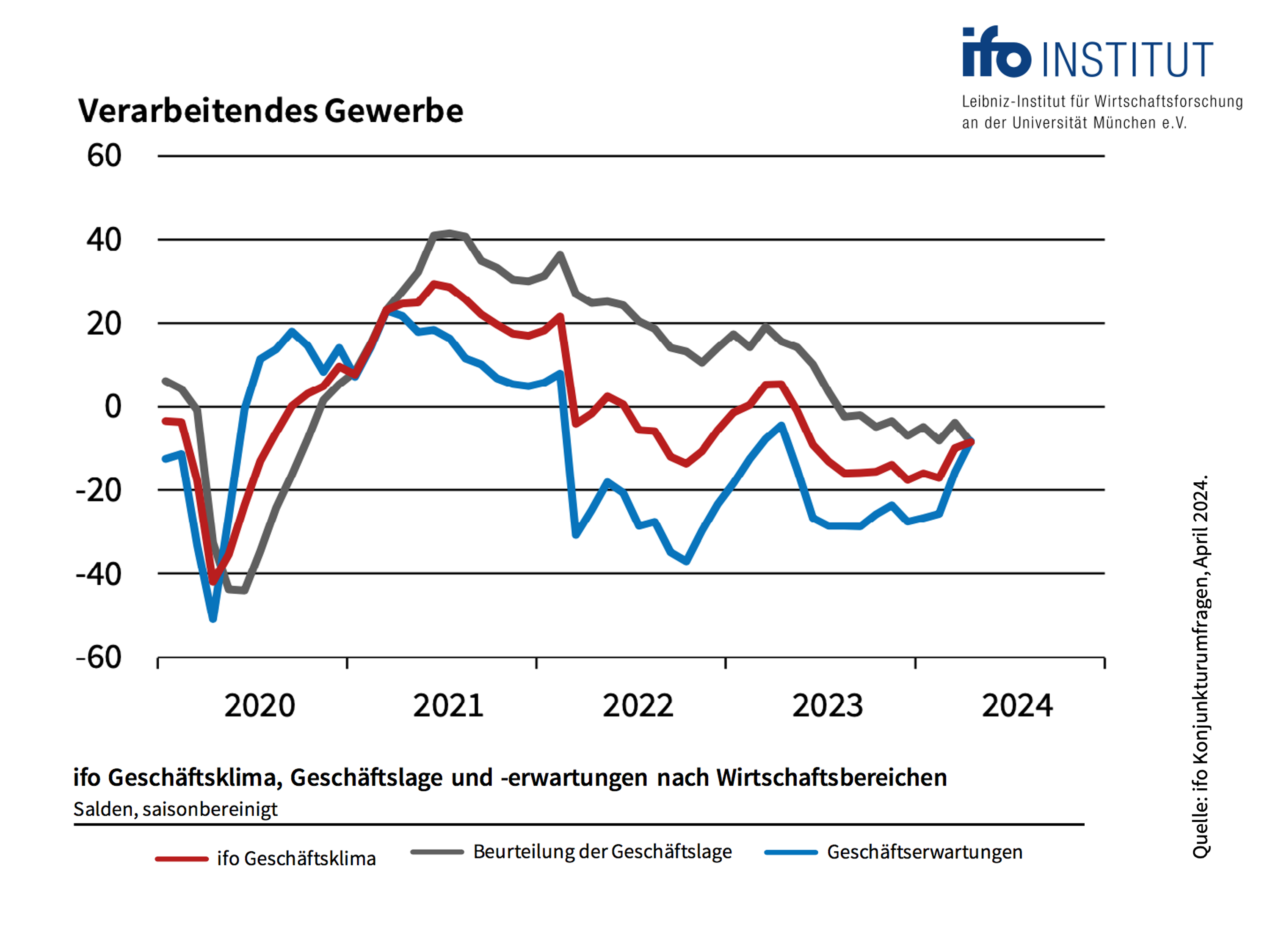

The improvement in industry, which is so important for the private wealth stock market indicator, is particularly impressive. The index for business expectations in the manufacturing sector made a big leap upwards (chart 2). In the last two months, it has jumped from minus 25.7 to minus 15.7 and now only minus 8.3 points. On balance, the number of company bosses who expect a more favourable business trend is now more or less in balance with those who anticipate a less favourable trend over the next six months. That is encouraging.

We already announced this improvement to you two months ago and also gave you the reasons for it (please refer to ‘News from the editorial team: Industrial economy may have bottomed out - continue to invest in equities’)

The current development underpins the positive assessment of the private wealth stock market indicator for the German stock market, which has been valid since October. As a reminder: In October 2023, the stock market indicator gave a buy signal when the DAX fell below 15,000 points. At that time, the equity allocation was initially raised to 100 per cent due to the stabilisation in business expectations. Since November, the stock market indicator has even been overweight in equities at 110 per cent.

The current constellation suggests that we should remain highly invested in equities. The path on the ifo economic clock from bottom left to top right has almost always been very lucrative for investors in the past. We have done the maths. There have been ten such movements since 1991. They lasted between nine and 24 months, with an average of 17 months. During this time, the DAX rose by an average of 35 per cent. Only once - from December 2001 to August 2002 - did investors record a loss in this way. In nine out of ten cases, it was very profitable to simply remain invested in such a mixed situation.

The bottom line for equity investors:

All three components of the private wealth stock market indicator continue to look promising. The economic indicator has been ‘green’ since November 2023. The current market valuation of the DAX relative to its long-term calculated value is slightly above its fair value following the price increase in recent weeks. However, the gap is not yet large enough to necessitate a reduction in the equity allocation.

The strategic corridor for the equity allocation in the private wealth stock market indicator therefore remains at 70 to 110 per cent of the individually planned equity allocation.

Within this range, the results of the capital market seismograph determine the exact positioning of the stock market indicator. As you know, the seismograph combines various variables - leading economic indicators, interest rate trends and price fluctuations on the stock markets. The probabilities for three market states in the coming month are distilled from this. Green stands for the expectation of a calm, positive market. If green dominates, investors should invest in shares. Yellow indicates the probability of a turbulent, positive market - investing, but with a sense of proportion. And red indicates the probability of a turbulent-negative market. In this case, abstinence from equity investments is the order of the day.

The probability landscape of the seismograph has been stable positive for some time. ‘This had not changed even during the correction due to the escalation of the Middle East conflict,’ informs Oliver Schlick, Secaro: ‘The probabilities for a positive, calm market dominate, the probability for negative turbulence is negligible. The seismograph therefore continues to consider an offensive equity positioning to be appropriate.’

Overall, the equity allocation of the private wealth stock market indicator therefore remains at the upper end of the strategic corridor at 110 per cent of the individually planned equity allocation. This means that anyone who, for example, considers an equity allocation of 50 per cent to be optimal based on their individual preferences in the strategic asset allocation should currently be 55 per cent invested in equities (110 per cent of 50 per cent results in an equity allocation of 55 per cent).

Yours sincerely,

Klaus Meitinger

Note: Despite careful selection of sources, no liability can be accepted for the accuracy of the content. The information provided on the private wealth website is for information purposes only and does not constitute an invitation to buy or sell securities.